How to Buy a House Using Halal Finance: Step-By-Step UK Process

Navigating Halal Home Buying in the UK

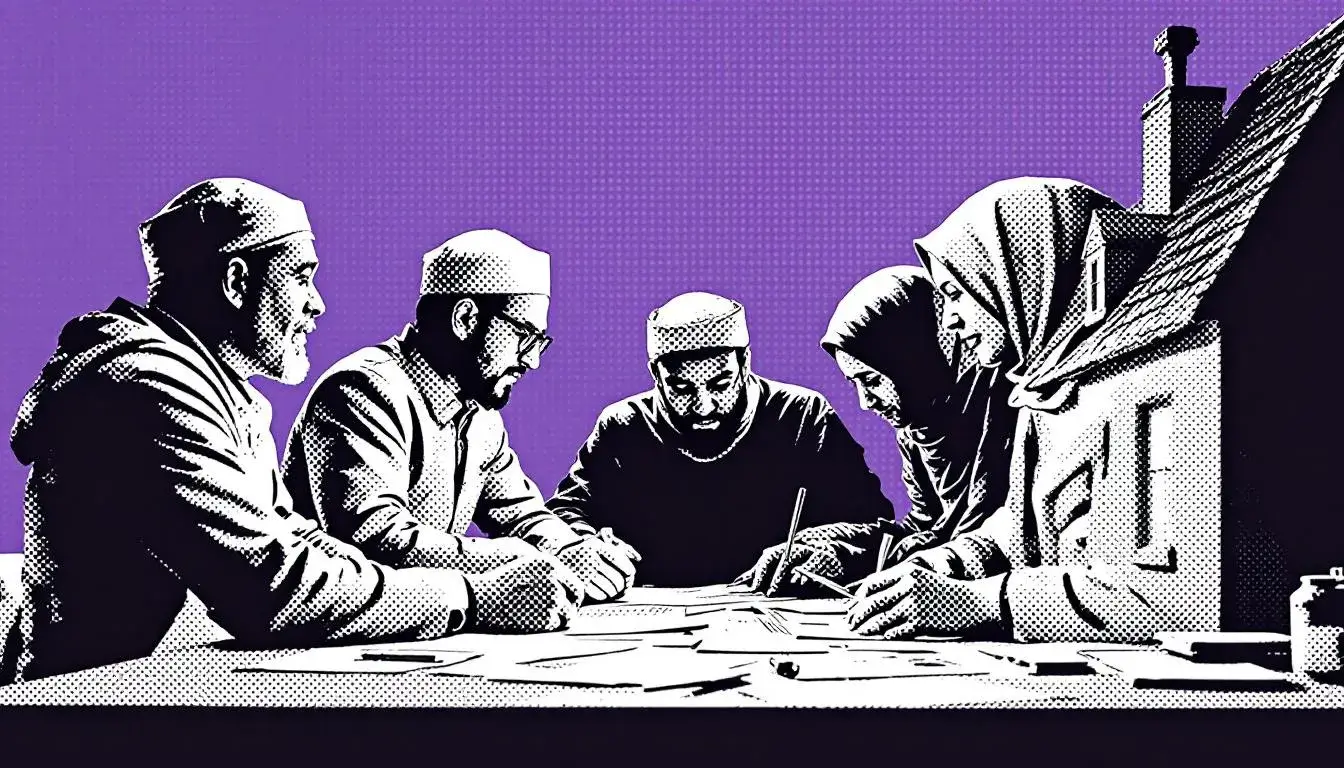

For many UK Muslims, the dream of homeownership is coupled with a commitment to faith. Conventional mortgages, grounded in interest payments, can present a dilemma for those seeking to adhere to Sharia law’s prohibition of riba (interest). Halal finance offers a solution, enabling buyers to purchase property while staying true to Islamic principles. This guide unpacks halal home buying in the UK—from terminology and eligibility to practical steps and key considerations—helping you make informed, faith-aligned decisions.

Who Should Consider Halal Finance?

Halal finance is designed for individuals who want to avoid interest-based lending for religious reasons. This includes:

Practising Muslims seeking Sharia-compliant alternatives

Homebuyers wishing to avoid conventional mortgage interest

Individuals looking for transparent, ethical finance options

It’s also suitable for families and first-time buyers who value ethical transparency in financial products. Even if you’re not Muslim, you may be drawn to the ethical principles at the heart of Islamic finance: risk sharing, asset-backing, and a ban on excessive uncertainty.

Key Concepts and Terminology

Understanding halal home finance means grasping a few essential terms:

Sharia: Islamic law, which prohibits interest (riba) and excessive risk (gharar)

Riba: Interest or usury, strictly forbidden in Islam

Ijara: Lease-to-own agreement, where the bank buys the property and leases it to you

Murabaha: Cost-plus sale, where the bank buys the property, sells it to you at a marked-up price, and you pay in instalments

Diminishing Musharaka: Partnership model, where you and the bank jointly buy the property; you gradually buy out the bank’s share

Main Halal Home Finance Options

There are three principal Sharia-compliant finance models in the UK:

Ijara (Lease to Own): The bank purchases the property and leases it to you. Part of your monthly payment goes toward rent, the rest toward eventual ownership. At the end of the term, ownership transfers to you.

Murabaha (Cost-Plus Sale): The bank buys the property and sells it to you at a predetermined, higher price, payable in fixed instalments. There’s no variable interest, just a clear mark-up.

Diminishing Musharaka (Partnership): You and the bank co-own the property. With each payment, your share increases and the bank’s decreases, until you own it entirely.

Each model has nuances affecting your payments, ownership timeline, and flexibility. It’s wise to compare them in light of your financial situation and future plans.

Cost, Impact, and Risks

Halal mortgages often come with slightly higher monthly payments or upfront fees compared to conventional products. This reflects the administrative complexity and the need for asset-backing. However, the cost structure is typically fixed and transparent.

Key risks and impacts:

Early repayment charges may apply

Limited providers in the UK can restrict options

Some products may require larger deposits (often 20–25%)

Property remains partly owned by the bank until the finance term ends

Despite these factors, for many buyers, the peace of mind from Sharia compliance outweighs these drawbacks.

Eligibility and Conditions

Eligibility criteria typically mirror those for conventional mortgages:

Minimum deposit (often 20–25%)

Proof of income and employment

UK residency or citizenship

Property must be suitable for residential use (not buy-to-let)

Some providers may have additional requirements, such as minimum property value or restrictions on certain property types.

Step-by-Step: Buying with Halal Finance

Assess eligibility and deposit amount

Research and compare Sharia-compliant lenders

Obtain a Decision in Principle (DIP)

Find a suitable property

Make an offer and appoint a solicitor

Complete the lender’s application and valuation

Review and sign the legal contracts

Final completion: receive keys, begin payments

Pros, Cons, and Key Considerations

Pros:

Sharia-compliant and interest-free

Transparent cost structure

Ethical, asset-backed finance

Cons:

Higher deposit requirements

Fewer lenders and products

May be less flexible for certain property types

Consider your long-term plans, as early exit or overpayments may be less flexible than with traditional mortgages.

Before You Decide: Points to Watch

Compare total cost: Look at the full repayment amount, not just monthly instalments

Check provider credentials: Ensure your lender is regulated by the Financial Conduct Authority (FCA) and certified by a reputable Sharia board

Understand all fees: Upfront, admin, legal, and potential early exit charges

Assess future flexibility: Can you overpay or exit early without penalty?

Alternatives to Halal Home Finance

If you find halal mortgages restrictive, consider:

Shared ownership schemes: Buy a share of a property and pay rent on the rest

Family help: Borrowing from family on an interest-free basis

Saving for a larger deposit: Avoiding finance altogether for a cash purchase

Each alternative comes with its own implications for ownership, security, and cost.

Frequently Asked Questions

1. Are halal mortgages more expensive than conventional ones? Halal mortgages can have higher upfront costs or require bigger deposits, but monthly payments are often similar to fixed-rate conventional deals.

2. Is Sharia-compliant finance regulated in the UK? Yes, FCA-regulated providers such as Al Rayan Bank and Gatehouse Bank offer Sharia-compliant home finance products.

3. Can non-Muslims use halal finance? Absolutely. Anyone can apply for these products if they meet the eligibility criteria and prefer the ethical structure.

4. Will I fully own my home at the end? Yes, after completing all payments, full legal ownership transfers to you.

5. What happens if I want to sell early? You’ll need to settle the outstanding finance. Check your provider’s early settlement terms for charges.

6. Are there government-backed halal schemes? Some shared ownership and Help to Buy schemes can be structured in a Sharia-compliant way. Speak with specialist brokers for details.

Next Steps

If you’re considering halal finance, start by calculating your deposit, then research FCA-regulated providers. Consult a Sharia-compliant mortgage broker for tailored advice, and seek legal counsel before committing.

Disclaimer

This article is for informational purposes only and does not constitute financial or legal advice. Always consult qualified professionals and verify Sharia compliance before entering any financial agreement.

Buy now, pay monthly

Buy now, pay monthly

Some of our incredible partners

Our partners have consistently achieved outstanding results. The numbers speak volumes. Be one of them!

Unique Blinds & Shutters NW

BRITANNIA MEDICARE LIMITED